|

1. 36% - Build Something Nobody Wants

2. 18% - Hire Poorly

3. 13% Lack of Focus

4. 12% - Fail to execute sales and marketing

|

BSI Innovation blogs about Innovation, Money, Venture Capital, Grants, Exports and Research and Development (R&D)

Alliance Partners

Wednesday, December 30, 2015

Top 4 Startup Mistakes that represent 80% of Failures

Sunday, December 27, 2015

There can be only One!

- social media for creatives - Redbubble

- business-software start-up - Apttus

- the cloud identity-management company Okta.

- referral system - Referron

- social media and data analytics - Keynected

|

| Will your unicorn be revealed as nothing more than a donkey with a cardboard tube taped to its forehead? |

Friday, December 25, 2015

Uber for...... A sharing economy

Uber for carers and seniors - Honor

Honor raises $20m - Matching Carers with Seniors

Uber for rides - Ride.com

Meerkat raises $18m - live streaming video

What it is: Meerkat is a new livestreaming app that syncs up with Twitter to let you live stream and share video in real time. The app quickly became a favorite of Product Hunt users several weeks after it was posted to the startup and app discovery website. It was a hit at SXSW as well. Sources tell TechCrunch that Meerkat now has more than 300,000 users. Meerkat initially depended on Twitter for its social graph. But Twitter acquired a rival livestreaming app called Periscope and then briefly crippled Meerkat by limiting its access. From a usage standpoint, however, both apps are now seeing similar engagement.

Funding: $18.2 million from Raine Ventures, CAA Ventures, Vayner/RSE, WME, Chad Hurley, David Tisch, Ooga Labs, Aleph, Entree Capital, DreamIt Ventures, Gigi Levy, Ron Gura, Eyal Gura, PLUS Ventures, Jared Leto, Universal Music Group, Broadway Video Ventures, Comcast Ventures, SherpaShare, Vaizra Investments, Slow Ventures, Kevin Colleran, Soma Capital, Greylock Partners

Website: http://meerkatapp.co/

Hot startup - gogoro

Thursday, December 24, 2015

Heres a $495 Christmas Gift for being you!

| ||||||||||

Friday, December 18, 2015

10 Gems for an Entrepreneur

click here to get the X Factor in your business

Tuesday, December 15, 2015

An open letter to entrepreneurs: Congrats, you made it

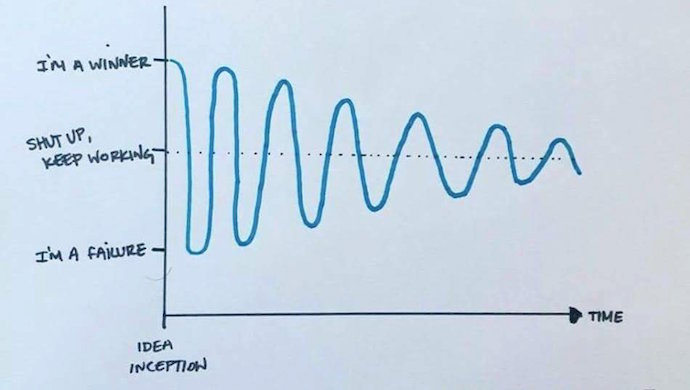

Starting up is not for the faint hearted!!! Welcome to club fear and the roller coaster ride of your life! It's a 24/7 hustling experience

By Beverly Tantiansu12 Dec, 2015

Entrepreneur Emotional Cycle

Dear Startup Entrepreneur,

Congrats – it’s the end of 2015.... And looking back, I am sure you will be wondering how you have survived and actually thrived!

You’ve done it, you’re running a startup. You even hired a team to boot. Congratulations.

Admittedly, there were times where you were close to giving up, but instead of disappointment punching you in the face, you decided to punch it first. So here’s a celebratory list of those particular moments.

1. When no one wanted to join you

It all starts with an idea — a crazy, yet incredibly feasible idea. Or you thought it’s feasible, the rest of the world seemed to think otherwise. Perhaps it was your young-looking face, the inexperience, and your lack of understanding of proper tech jargon that turned people away, but it could’ve been other factors, right?

Whatever it was, people veered away from you and that was difficult. Because your idea could change people’s lives. Could possibly be the Next. Big. Thing. So you decided to stop caring about what the naysayers said. You decided that just like love, or any relationship, there will always be people who understand you for you.

“These are my friends. These are people who have got my back.”

You’ll tell yourself those words later when the tough got tougher, and perhaps, some of them already feel like brothers and sisters. They’ll stay with you through the late nights, the last-minute changes, the product crashes, and the launch celebrations.

And suddenly you’ll realise, your dream became their dreams too.

2. When no one wanted to invest

So we come to the next challenge: investment.

Now it’s convincing a bunch of people with a lot of money that you’re worth it. Sure you’ve got a small team behind your back, but these people have read thousands of pages of hilarious and horrible pitch decks – so you wonder where your investor deck will fit in.

You wrote the best email your brain could craft, you pitched your hardest – but then, those haunting words were said: “You’re too early.”

And maybe they’re right. After all, you’re not the first fintech, edutech, somethingtech startup to grace their presence. So, you decided to make lemonade out of the lemons you were given. It hurts to be rejected, but it takes guts to accept criticism and improve from that.

So every opportunity you got, you decided to receive mentoring from these experts, showing and updating them at every opportunity with your latest product launches and startup developments…

Because someday, you tell yourself, you’d like to prove them wrong. That while you may not be like the fabled unicorn, you think that you’re a strong, resilient, pony.

Also read: Are Indian startups headed for a bubble burst?

3. When you ran out of money

In the end, you managed to pool in some funds and ask family and friends for support, get a bank loan whenever possible, and have some angel investors chip in some cash for a reasonable amount of equity.

And while it wasn’t enough to buy you new technology, or hire more people it allowed you to continue working on the prototype and keeping your core team afloat. But then reality throws a punch at you, and you realise there’s not going to be enough money in the bank soon. Crap.

You’ve exhausted most of your options the first time, so you gather your core team and have the “talk.” You tell them how things are, how financials look — you’re not sure if you should be optimistic, realistic, or pessimistic. Whatever. You don’t know yourself. So you admit that and watch and wait for their reactions.

You all make sacrifices. Just make the product work. Fix all the bugs. Sell, sell, sell. It’s easy to read this all now, but it was painful to be in those months of torture. Patience was low, fights happened – but despite those rocky roads, you eventually weathered it out.

You either convinced an investor, decided to take up part-time jobs to keep yourself and the company alive, whatever it is: you felt that this was your first entrepreneurial war. And to tell yourself and your loved ones, that yes, I’m still surviving, still being healthy, is something that you’re thankful for. In the end, you continue to be an entrepreneur.

4. When people start to leave

It’s close to a year since your team got together. You’ve perhaps started winning several contests, hackathons, got some screen time on the big stage either as a speaker or a pitching engagement. You’ve already shown the ecosystem your MVP and are working towards progress.

Then another thing happens. People start leaving. Perhaps it’s one of your employees, or maybe your co-founder decided to do a little side project and two or three employees followed. Or maybe you had to fire them. You try not to get too attached, and yet you can’t help but wonder how they’re doing.

“I hope they’re doing well. Wherever they are,” you tell yourself.

Probably social media reminds you that you’re still virtually connected, so you like their posts, you congratulate them. But a tiny part still aches, and it’s all right.

Because if you love them, you let them go – a good founder knows that they can’t keep their employees with them forever. Good founders look forward, to the future, and accept the challenges that lie ahead of them.

And well, if you ended it on a bad note, you still manage to be professional with them whenever you run into each other. The startup world is small, and drama can take a backseat.

Also Read: Hootsuite cuts 40% of APAC staff from Singapore office

5. When you had to pivot

“Fail fast, fail forward” – that’s what the startups say. And yet, admitting that you were wrong is difficult. Sometimes self-doubt sets in. Did you really lead innocent people to the valley of death? Or was your idea, no – your dream, worth fighting for?

“But the data shows…” Yes. You get it. Enough with the Big Data analytics. Statistically, you need to change your strategies. Your valuation is taking a hit. You’re getting complaints from your investors, shareholders, employees.. everyone.

So you get on with it, like you always have. You make a startup-wide announcement; if needed, issue a press release. And some of your critics laugh and say, “Pivoting again, I see.” But instead of giving them a snide remark you bite your tongue, nod politely, and carry on. Because every majestic and beautiful butterfly started off as a caterpillar.

And here you are, back to reality. Life wasn’t meant to be fair, and to many others, startups are meant to fail. And yet you didn’t. You’re still here, submitting us stories of your successes, your latest product releases and next ventures. You definitely know that the journey’s not yet over, and that’s okay. We’ll be here to cheer you on and hope for the best.

As Steve Jobs said,

“Here’s to the crazy ones, the misfits, the rebels, the troublemakers, the round pegs in the square holes… the ones who see things differently — they’re not fond of rules… You can quote them, disagree with them, glorify or vilify them, but the only thing you can’t do is ignore them because they change things… they push the human race forward, and while some may see them as the crazy ones, we see genius, because the ones who are crazy enough to think that they can change the world, are the ones who do.”

Congratulations for surviving the entrepreneurial roller coaster and braving the new year to ride it all over again. Cheers for being you.

Yours,

Bev Tan

Image Credit: Kyro Beshay

Friday, December 11, 2015

How Zapier got off the ground

The types of things people do that Zapier automated tend to fall into a few categories.

- Notifications – One popular one is notifications, like an alert when someone RSVP’s on EventBrite or a payment comes in through Paypal. Those might come through e-mail, Slack, Hipchat, SMS, or something else.

- Lead generation – Another big category is lead generation, so gathering information from a website form, an e-mail, etc. and saving to a CRM, an e-mail marketing tool or something like that.

- Archiving – Saving files into Dropbox, Google Drive, Onedrive, things like that, or opening notes into apps like Evernote.

Wednesday, December 09, 2015

Blue Sky raising a $200m expansion fund

ASX-listed investment group Blue Sky Venture Capital is trying to raise its third fund - a $200 million to fund expanding technology firms and keep more successful local companies at home for longer.

Blue Sky will back companies that have begun to establish themselves and are looking to start expanding or attacking new markets, usually with funding rounds ranging from $10 to $30 million.

Blue Sky Investment director Elaine Stead told The Australian Financial Review that there had been a shift in attitude among Australian institutional investors towards backing companies in the tech sector, as more success stories emerged. She said it needed to raise a larger fund to be able to back the kinds of growing and successful startups, that may otherwise have had to head overseas for expansion capital.

"There is now so much funding available for the angel and seed funding rounds, because that area was previously very thirsty, but Australia also needs to have enough capital available to support the wonderful opportunities that make it through to series B funding stage and beyond, which actually need a lot more capital to scale up," Ms Stead said.

"It is not a bad thing necessarily if a company moves overseas to attack larger markets, but it would be great if we could nurture Australian success stories in Australia for a lot longer. That will make a difference in terms of jobs, in returns for investors and will improve economic outcomes all around."

TAPPING INSTITUTIONAL FUNDS

Ms Stead said the fund raising had begun and superannuation funds had already shown interest, which marks an important turnaround for funds that previously viewed tech startups as too risky and small to bother with. It follows news in September that Blackbird Ventures had succeeded in getting First State Super and Hostplus Super on board a $200 million startup fund it is managing.

Earlier on Tuesday First State Super revealed it will invest tens of millions of dollars into fintech start-ups over the coming years, under a partnership with H2 Ventures, a specialist fintech VC fund. Alongside the Blackbird fund First State, which manages $54 billion, wants to deploy $250 million into technology companies in the next few years.

The news will also be music to the ears of Prime Minister Malcolm Turnbull and his government, which made the need to attract more investment in the tech startup eco-system a key pillar of its National Innovation and Science Agenda, announced on Monday.

Assistant Minister for Innovation Wyatt Roy said the new Blue Sky fund, as well as the H2 Ventures announcement showed that the environment had begun to change for innovative tech companies looking to grow in Australia.

"This is a very exciting time, in developing a uniquely Australian innovation eco-system," Mr Roy said.

"This represents a point where we are starting to see very large amounts of capital invested into Australian Innovation with institutional backing, and it is a very big development."

FUNDING FOR 2016

Ms Stead said the new fund, to be known as VC2016, would likely be closed in the second quarter of 2016, and would largely target Australian firms, although it would not be exclusively Australian focused.

In the last year, Blue Sky's existing venture capital funds invested in on-demand consumer retail business Shoes of Prey, last mile delivery network and logistics technology company ParcelPoint, fast casual retail chain THR1VE, and Minneapolis-based medical device company Conventus Orthopaedics.

The company recently exited head lice treatment company Hatchtech in a $US197 million deal with Indian-based Dr. Reddy's Laboratories.

"We want to try and structure the fund so that it gives our investors access to opportunities from the US and Asia as well, so about 75 per cent of our deal flow is still Australian, but we will look at the best opportunities no matter where they are," Ms Stead said.

She said the average deal size coming through its due diligence processes was $18 million, and that there were currently more opportunities out there than could be backed. She said that out of $1 billion raised in Australia this year through VC funds, only 20 per cent of it was targeted at the later stage companies that Blue Sky targets, meaning many viable investments were slipping through the net.

Despite being more established than very early stage startups, Ms Stead said the companies backed still needed to be given time to deliver returns, so super funds and other institutions actually made idea backers.

"Venture capital needs patient capital that can tolerate a long-term investment strategy, and that fits comfortably with superannuation mandates," she said.

"Institutional funding is slowly re-entering the Australian private capital market, which means companies are able to remain private for longer, rather than having to explore the public markets before they are ready."

Read more: http://www.afr.com/technology/blue-sky-venture-capital-raising-200-million-fund-to-back-tech-startups-20151208-gli46a#ixzz3tlXwxbe6

Follow us: @FinancialReview on Twitter | financialreview on Facebook